Global solar PV manufacturing production slows

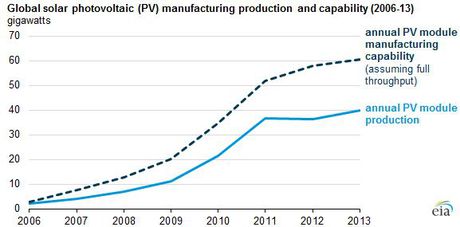

Growth in solar photovoltaic (PV) module production has slowed in recent years to 4% annually from 2011 to 2013 after increasing by an average of 78% from 2006 to 2011, according to the U.S. Energy Information Administration.

The gap between global PV module manufacturing capability and production has also grown, leading to lower utilisation rates of manufacturing facilities, according to EIA’s new ‘Today in Energy’ brief.

The utilisation rates of PV module manufacturing facilities (in terms of actual production as a percent of maximum throughput) peaked in 2011, when production was 36.6 GW and capability was 52 GW, giving a utilisation rate of 70%. In 2013, although production and capability increased slightly, the use rate of manufacturing facilities declined to 66%.

Sales of solar PV panels manufactured in China into North American and European markets at extremely low prices have led to complaints of unfair trade practices. Based on an investigation that found Chinese solar PV modules were being dumped or subsidised in the US market, the US Department of Commerce established anti-dumping and anti-subsidy duties on PV modules from China. In Europe, the European Commission and the major Chinese manufacturers reached an agreement on minimum prices and shipping volume.

The market is reacting to the slow growth of module production and the decreased utilisation of PV manufacturing capability by downsizing and consolidating PV manufacturing companies.

For example, Germany reported to the International Energy Agency that there were a total of 11,000 employees working in 40 PV companies operating in Germany at the end of 2013, compared with 32,000 employees in 62 companies at the end of 2008.

Similar trends were reported in China, with Chinese PV module and cell manufacturers decreasing from 300 companies to fewer than 100 companies. Despite the consolidation of Chinese manufacturing companies, China continues to be the largest producer of PV modules, manufacturing 23 GW in 2012 and 26 GW in 2013, or more than 60% of annual global PV module production in those years, mainly to serve export markets.

China ranks just ahead of the United States as the sixth-largest installer of solar photovoltaics. However, China has announced a goal of installing 100 GW by 2020, almost as much as the 2020 targets of Germany, Italy and Japan combined.

Future demand for solar photovoltaics will be affected by major countries’ goals for installed solar capacity. More than 50 countries have established national solar targets, amounting to more than 350 GW by the year 2020. The current top six countries in terms of total installed solar capacity — Germany, Italy, Japan, Spain, France and China — represented 76% of installed capacity in 2012, but only 61% of the global target total for 2020. Reaching 350 GW by 2020 would require average annual instalments of 40 GW from 2013 through 2020, which is equivalent to manufacturing production in 2013 and well within current PV manufacturing capability of 60 GW per year.

In some cases, national targets are not indicative of a country’s future solar PV market. For example, the United States does not have a national target. Instead, several individual states have established renewable portfolio standards, some with separate targets explicitly for solar. Furthermore, countries tend to adjust their targets. For instance, India recently increased its solar target from 20 GW to 100 GW by 2022.

CICCADA project to analyse Australia's consumer energy

The $4.3m initiative will examine the use of consumer energy resources in order to understand how...

NSW EV charging network expands

A new initiative has brought 39 pole-mounted kerbside chargers to Sydney’s inner west, with...

SA Power Networks to trial eco-switchgear

The network operator will be extending an existing partnership with Schneider Electric in order...